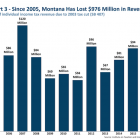

Revenue losses from Montana tax cuts passed in 2003 are approaching $1 billion, a new report says. “The Montana We Could Be: Tax Cuts, Aimed at the Rich, Take a Toll,” a report by the nonprofit Montana Budget and Policy Center in Helena, estimates that the tax cuts will have cost $976 million by the end of 2016. That’s enough to pay the deferred maintenance costs for all of the school districts in the state, the report says. The tax cuts, which took effect in 2005, reduced the number of tax brackets from 10 to six and cut the top income tax rate in Montana from 11 percent to 6.9 percent. The legislation also, among other changes, gave a 2 percent tax credit on capital gains. Continue Reading →