In the weeks following Donald Trump’s inauguration, I enumerated the first three ways that the then-new president had disappointed his Montana supporters. (more…) Continue Reading →

Last Best News (https://montana-mint.com/lastbestnews/tag/montana-budget-and-policy-center/)

In the weeks following Donald Trump’s inauguration, I enumerated the first three ways that the then-new president had disappointed his Montana supporters. (more…) Continue Reading →

Now that our national leaders are learning that sexual harassment is a bad thing, what comes next? Learning to use forks and spoons? (more…) Continue Reading →

Bob Story, executive director of the Montana Taxpayer Association and a former state legislator, has struck back with an op-ed piece taking on claims that income tax cuts passed in 2013 are cutting into school maintenance funding today. Story probably was referring to an opinion piece by educators, but since Last Best News has reported in considerable detail on this topic, allow me to retort. Those old tax cuts matter because gubernatorial candidate Greg Gianforte has argued that income tax revenues actually increased after the cuts, and he has proposed doubling down by cutting rates even more. (more…) Continue Reading →

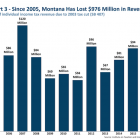

Revenue losses from Montana tax cuts passed in 2003 are approaching $1 billion, a new report says. “The Montana We Could Be: Tax Cuts, Aimed at the Rich, Take a Toll,” a report by the nonprofit Montana Budget and Policy Center in Helena, estimates that the tax cuts will have cost $976 million by the end of 2016. That’s enough to pay the deferred maintenance costs for all of the school districts in the state, the report says. The tax cuts, which took effect in 2005, reduced the number of tax brackets from 10 to six and cut the top income tax rate in Montana from 11 percent to 6.9 percent. The legislation also, among other changes, gave a 2 percent tax credit on capital gains. Continue Reading →